After three days of self indulgent speeches by Republican Governors and repeated lies about the out of context words 'you didn't build that' and false statements about Obama's hidden agenda to screw the elderly by stealing from medicare, I was actually looking forward to Romney's speech. I wanted to hear for myself how this potential President of the United States would explain how he plans to make things better for the people of this great country.

But, if you're someone who is not easily impressed, a thinker, or use to dealing with facts, then you were probably disappointed by Romney's address to the Republican National Convention.

After getting by all the fakery about being concerned that Obama was unsuccessful and that America deserved better, Romney started getting into the complaints about the current administration.

Romney's explanation of Obama's failure is based on the fact that he does not have business experience. It may seem reasonable to ordinary Americans that a CEO would be a good person to fix our struggling economy, but is this necessarily true?

The most important thing driving the actions of a Corporate businessman like Romney is to make a profit through the sale of goods or services. A government not only does not sell goods or services, it also does not have a profit motive. A government is driven by concern for all members of it citizenry. Sometimes that concern is in the form of social programs to help Americans through times of hardship. Sometimes it means building an infrastructure of roads, bridges and technology that benefit society and provide citizens and businesses a means to accomplish more. In Corporate America, times of economic difficulty usually mean that a Corporate CEO takes actions to reduce those elements of cost that he believes are not indispensable. Interpreting this into a CEO-President Romney terms, this means cutting those social programs that the government provides. As expected Romney was short on explanations of how his business experience at Bain Capital would help him be a better President than Obama. How much he believes the importance of business experience may have been exposed today when he mis-spoke and called America a "Company" instead of a "Country."

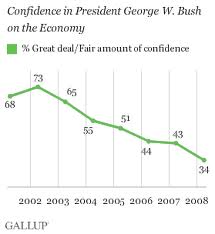

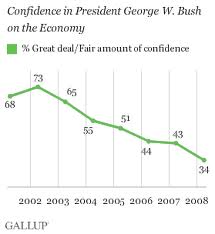

Romney dismisses the idea that the economic problems we have been experiencing were the result of the Bush Presidency. He simply states that Obama should just accept the blame for it because he hasn't gotten us out of it yet. This is as anti-intellectual as stating that the person sent in to help fix a mess confess that he created the mess because he wasn't done cleaning up yet. People have to realize that the recession we are in is the worst economic disaster since the Great Depression. That disaster took nearly fifteen years to get resolved. Instead, Romney would return to Bush era practices that caused our present economic situation. Additionally, Romney would not mention that there are many signs that the economy is improving and has been since Obama came into office. Obama's policies are working despite all the obstruction that Republicans in Congress have caused in order to prevent him from being successful. As they have stated themselves, Republicans in Congress had a most important objective to obstruct everything Obama proposed in order to make him appear to be impotent and unsuccessful. They did this in the midst of the economic disaster and they did it to the detriment of the American people they are sworn to represent.

|

| Jobs under Bush (red) vs Obama (blue) |

Romney claims that Obama crushed the middle class because there are no jobs. He does not admit that since Obama has been in office new jobs have shifted their negative trend from the Bush era and have been on a constant increasing trend.

Romney says that Obama hates small business and intends to increase taxes on small business. He does not admit that Obama has only reduced taxes on small business since he has been in office. Obama's newest proposal for taxes does not increase tax on small business. Government programs such as the Small Business Administration are strong and helping small businessmen and women everyday.

In his speech Romney continues the lie about Obama stealing 716 Billion dollars from medicare to fund Obama-Care. I hope everyone knows that this lie which has been disproved by numerous independent sources will not become true simply because the Republican leadership re-states it over and over again.

His speech took on a very militaristic character at one point. I thought for sure he was against cutting the military budget because he has plans to start a war with Iran if he was elected.

Romney concluded his speech with promises to the American people. Romney gave no detailed explanation of how these promises will be accomplished so I guess he just wants us to trust him. He promised:

1. Twelve million new jobs. It has been estimated that we are currently on a path to accomplish this without any new Romney actions within four years, so I guess this one is possible, but still an empty promise.

2. Energy independence by 2020. This claim is made even though Romney is critical of Obama's interest in funding research on new forms of energy. Romney has signed onto the Oil and Coal coalition as well, so I guess he intends to drill and dig more in America. We have been told many times by the oil companies when they increase gas prices, that oil is in limited supply. So over the long term how does Romney expect to become energy independent?

3. Create new trade agreements and punish any country that cheats. Which countries and how punishment would be carried out was left to our imagination.

4. Assure that the "job creators" investments won't vanish. Romney will also cut the deficit and balance the budget. None of this is explained, but protecting the wealthy investors sounds like tax law reform and Wall Street regulation is not high on Romney's agenda.

5. Reduce taxes on business. I guess this is to support the job creator lie or maybe to give more credence to the possibility that the job creators really will turn away from American workers as an effective threat against having their taxes raised.

6. Repeal (and now replace) Obama-Care. I can't believe Romney thinks taking health insurance away from the American people will be seen as a good thing to anyone except die-hard (and healthy) Republicans. Again Romney gives no explanation on any of this.

In concluding his speech, Romney's additional unexplained rhetoric included statements that seemed intended as a band-aid to cover what has recently become controversial about Republicans. He vows to care for the sick, statements apparently made to soften the view that he intends to repeal Obama-Care. He claims that he will respect the elderly, seemingly trying to change the popular view that Republicans like he and Ryan have plans to change Medicare into a voucher program.

Empty promises claiming certainty of success may sound good but without details give us no factual information to evaluate whether they will ever be achievable. I guess we'll need to listen closely to Romney's explanations if they exist in future appearances.

I'm so looking forward to the Presidential debates in October. Perhaps by then Romney will have better explanations for his promises. If not, President Obama will walk all over him.

Romney's head will be spinning and he'll probably have to admit that his Party really was not only responsible for the current economic disaster, but also responsible for blocking progress on resolving it.